Meet Your Next Hire

Ampliwork's AI agents are purpose-built for complex organizational challenges, combining enterprise-grade security, regulatory compliance, and adaptive intelligence. Each agent elevates how enterprises work - freeing teams to focus on strategic innovation while ensuring operational excellence at scale. Talk to an expert today

Talk to an expert todayMeet Some of Our Agents

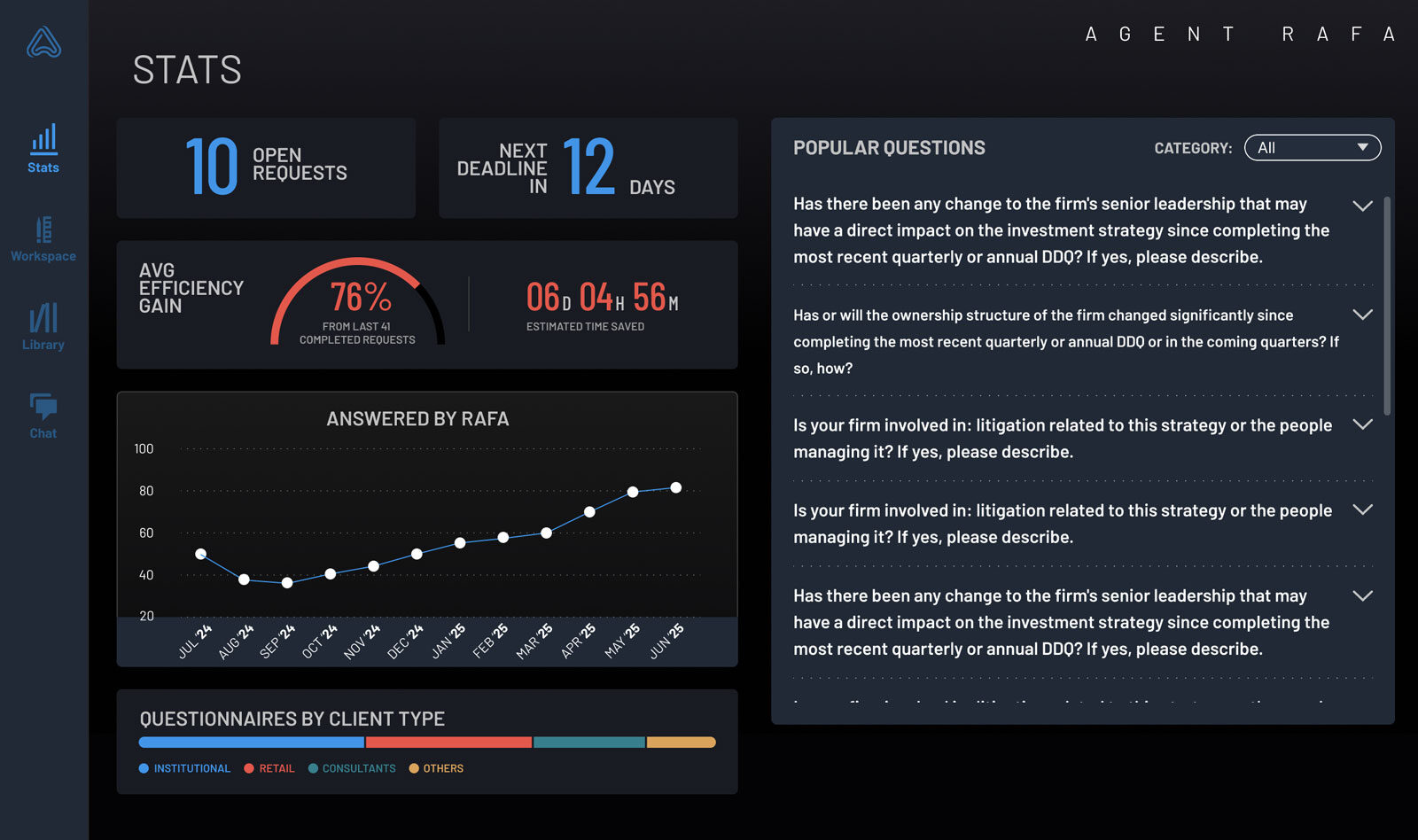

Agent RAFA

AI-Powered RFP & DDQ Compliance Agent Asset Management | Investment Firms | Financial ServicesAgent RAFA is an enterprise-grade AI compliance specialist purpose-built to manage RFP and DDQ responses in the highly regulated world of asset management and investment firms. Designed with a compliance-first approach, RAFA ensures data security, regulatory adherence, and operational efficiency while delivering a significant ROI by reducing manual effort and response inconsistencies.

Skills

- Compliance-First Approach – Every response aligns with regulatory standards, internal policies, and client-specific requirements.

- ROI Optimization – Minimizes response time, reduces operational costs, and ensures high-quality, audit-proof submissions.

- Enterprise-Grade Security – End-to-end data encryption, SOC2 & GDPR compliance, and role-based access control for secure document handling.

- Risk Reduction – Identifies potential compliance gaps, ensuring all responses adhere to industry and legal standards.

- Scalability & Process Optimization – Reduces manual workloads and allows asset managers to handle increasing volumes of RFPs & DDQs with precision.

“RAFA has transformed our RFP process, cutting our response time in half while ensuring 100% compliance with our internal risk policies.”

Director of RFP Management, Global Asset Firm

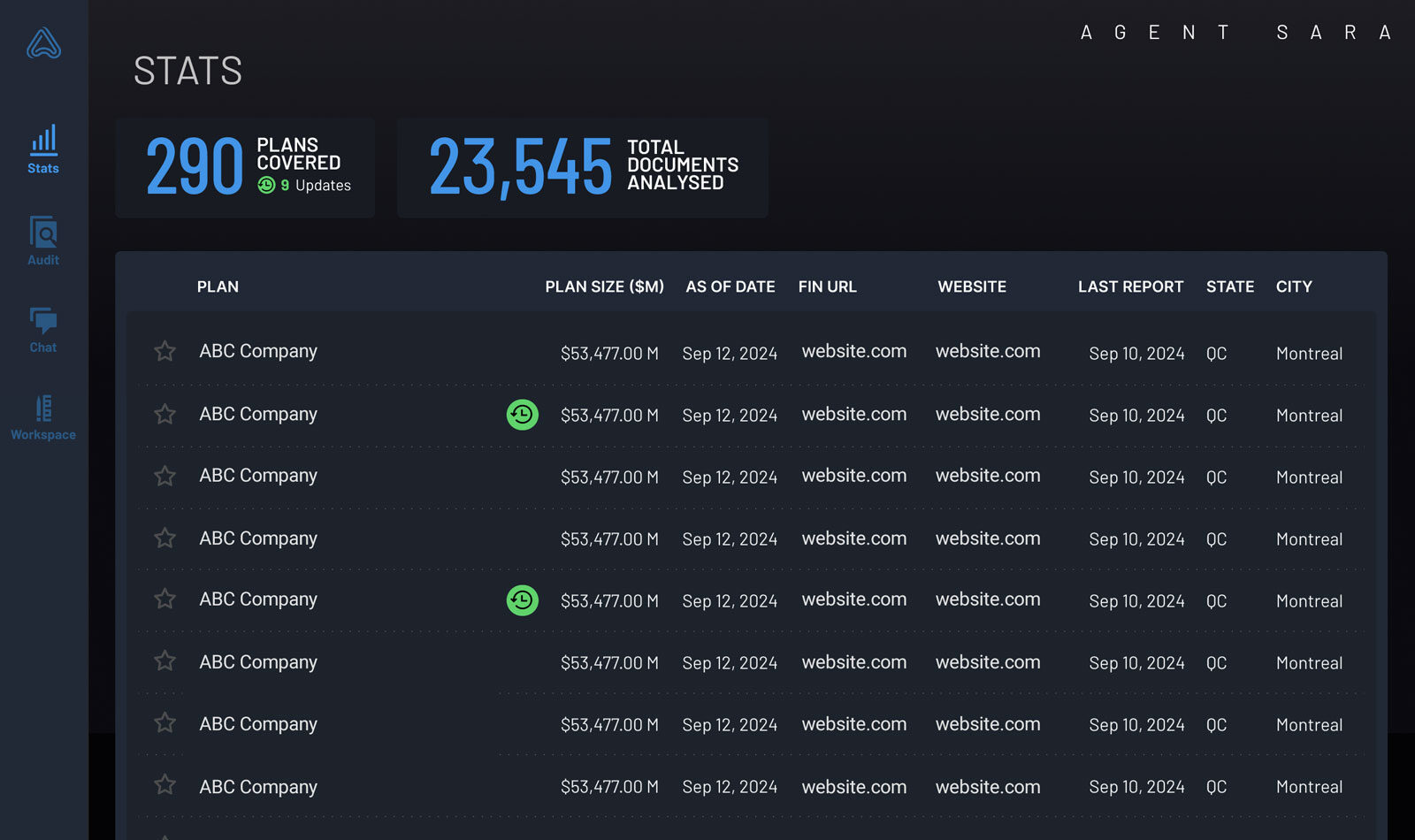

Agent SARA

AI-Powered Institutional Sales & Research Agent Lending Institutions | Mortgage Insurance | Financial ServicesAgent SARA is an AI-powered Institutional Sales & Research Assistant designed to enhance the capabilities of investment managers, sales teams, and investor relations professionals. With advanced language models and deep financial knowledge, SARA processes large volumes of investment data, provides strategic insights, and assists in research driven decision-making to improve client engagement.

Skills

- Compliance-First Approach – Ensures adherence to Fannie Mae, Freddie Mac, CFPB, and FHA lending regulations.

- Risk Mitigation – Identifies legal inconsistencies and prevents financial penalties and litigation risks.

- Enterprise-Grade Security – End-to-end encryption, SOC2 compliance, and role-based access controls for document security.

- ROI-Driven Impact – Reduces manual review time by 60%, leading to faster closings and increased loan volume.

- Document Processing – Accurately extracts, verifies, and organizes complex mortgage data across systems.

“Agent SARA has transformed our sales process, enabling us to curate investment insights in real-time, saving us hours in research.”

Head of Institutional Sales, $1T+ AUM Asset Manager

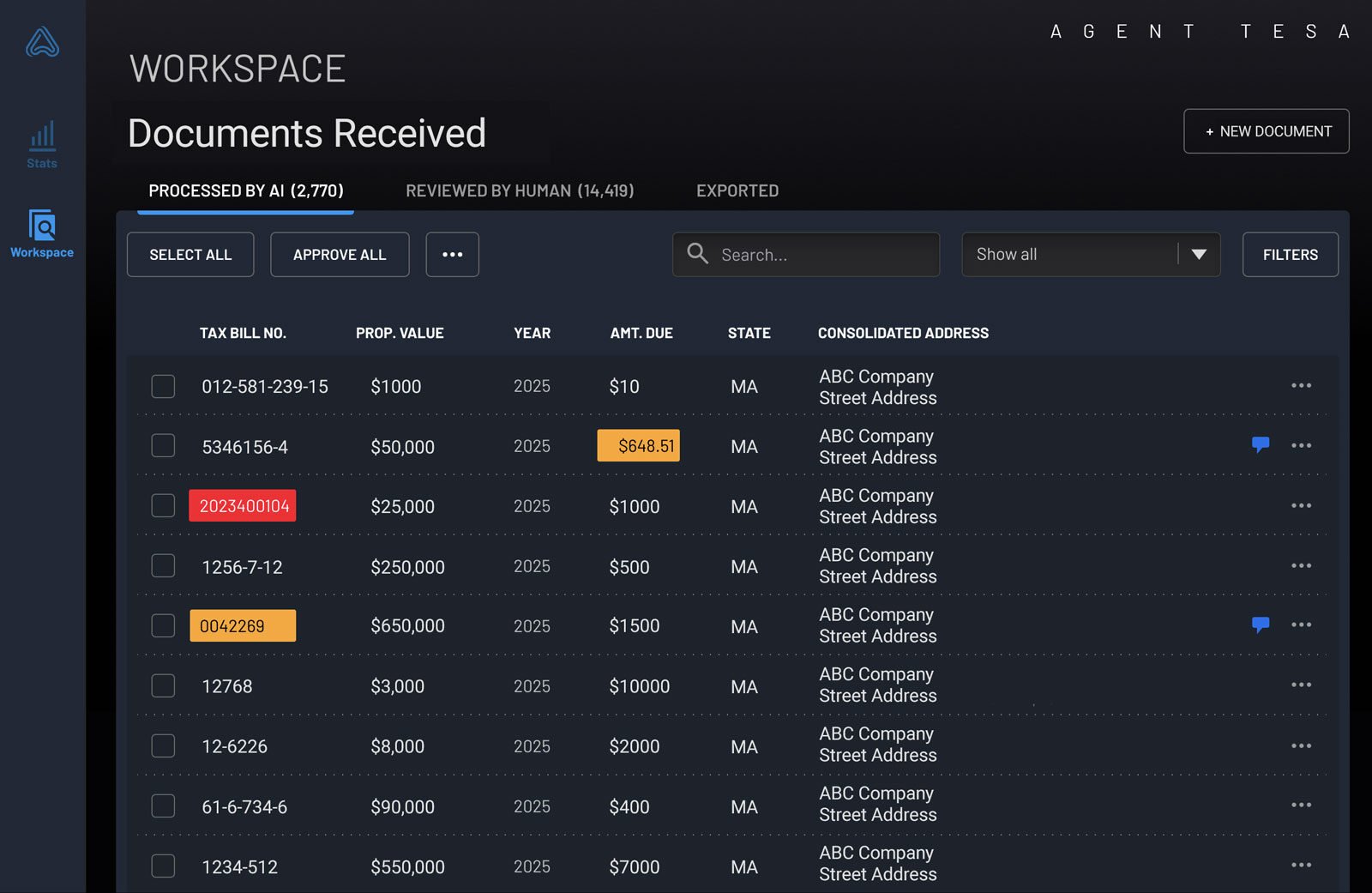

Agent TESA

AI-Powered Document Processing Agent Consulting Firms| Compliance Automation | Financial ServicesAgent TESA is an AI-driven document processing specialist designed to streamline complex workflows for consulting firms and financial service providers. Equipped with advanced AI-powered classification, and intelligent data validation, TESA automates the end-to-end processing of high-volume, high-variability documents such as tax bills, insurance forms, escrow statements, and more.

Skills

- End-to-End Document Automation – Extracts, classifies, and validates data from diverse document types with precision.

- Multi-Format Document Intelligence – Seamlessly handles scanned forms, PDFs, image files, and hybrid digital-paper workflows.

- AI-Powered Data Accuracy – Reduces manual data entry and human error through intelligent parsing and cross-verification.

- Compliance-Ready Workflows – Ensures adherence to institutional, state, and federal regulatory standards.

- Scalable Document Infrastructure – Built for high-volume processing across loan servicing, insurance, and escrow operations.

- Secure & Auditable by Design – SOC 2 compliant architecture with encryption, access control, and audit logs.

“TESA transformed our back-office operations—cutting manual processing time, eliminating errors, and accelerating compliance.”

Director of Operations, Consulting Firm

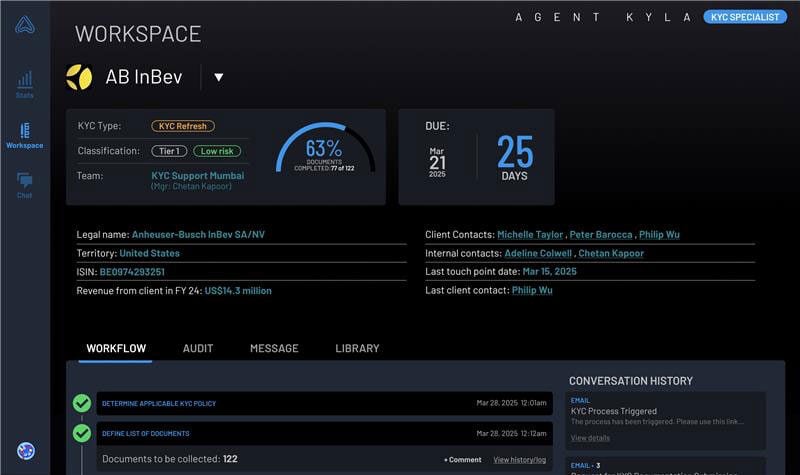

Agent KYLA

AI Agent purpose-built to streamline and automate KYC (Know Your Customer) processes in Financial Services, powered by state-of-the-art AI and domain-specific compliance frameworks.

Core Value Proposition

- Accelerate Customer Onboarding: Reduce KYC processing times dramatically—from weeks to just days or hours.

- Enhance Compliance & Accuracy: Ensure consistent adherence to regulatory standards with AI-driven precision.

- Mitigate Risk & Operational Burden: Handle high volumes of KYC checks without compromising quality or compliance.

- Future-Proof Regulatory Framework: Stay ahead of evolving regulations with adaptable AI models and industry-specific compliance templates.

Skills

Key Features & Differentiators- Technical Differentiation: Utilizes proprietary IP and technology-agnostic models optimized with both proprietary and open-source LLMs, delivering unparalleled accuracy and integration capabilities.

- Domain-Specific AI: Tailored specifically for financial services, ensuring comprehensive coverage of complex KYC and AML requirements.

- Centralized Compliance Hub: Consolidates all customer data and compliance requirements into a single, unified platform for streamlined management and regulatory reporting.

- Human-in-the-Loop Oversight: Combines automated processes with human expert validation to refine KYC checks, minimizing false positives and enhancing efficiency.

- Audit Trails & Transparency: Provides detailed, timestamped audit logs for every verification step, enabling full traceability and regulatory transparency.

- Rapid Integration & Scalability: Quickly deployable within 12 weeks with seamless integration into existing enterprise systems, scalable to manage increasing client volumes and regulatory complexity.

Tangible Outcomes

- Faster Client Onboarding: Cut onboarding times by up to 80%, enabling quicker revenue realization.

- Improved Compliance Assurance: Ensure 100% regulatory compliance and significantly reduce compliance risks.

- Operational Efficiency: Decrease manual workload on compliance teams, allowing experts to focus on high-value tasks.

- Cost-Effective Performance: Leverage a pay-for-performance pricing model that guarantees cost savings against current labor costs.

“Agent KYLA drastically reduced our KYC backlog, turning weeks of work into just a few days. Compliance has never been smoother.”

Head of Compliance, Leading Investment Bank